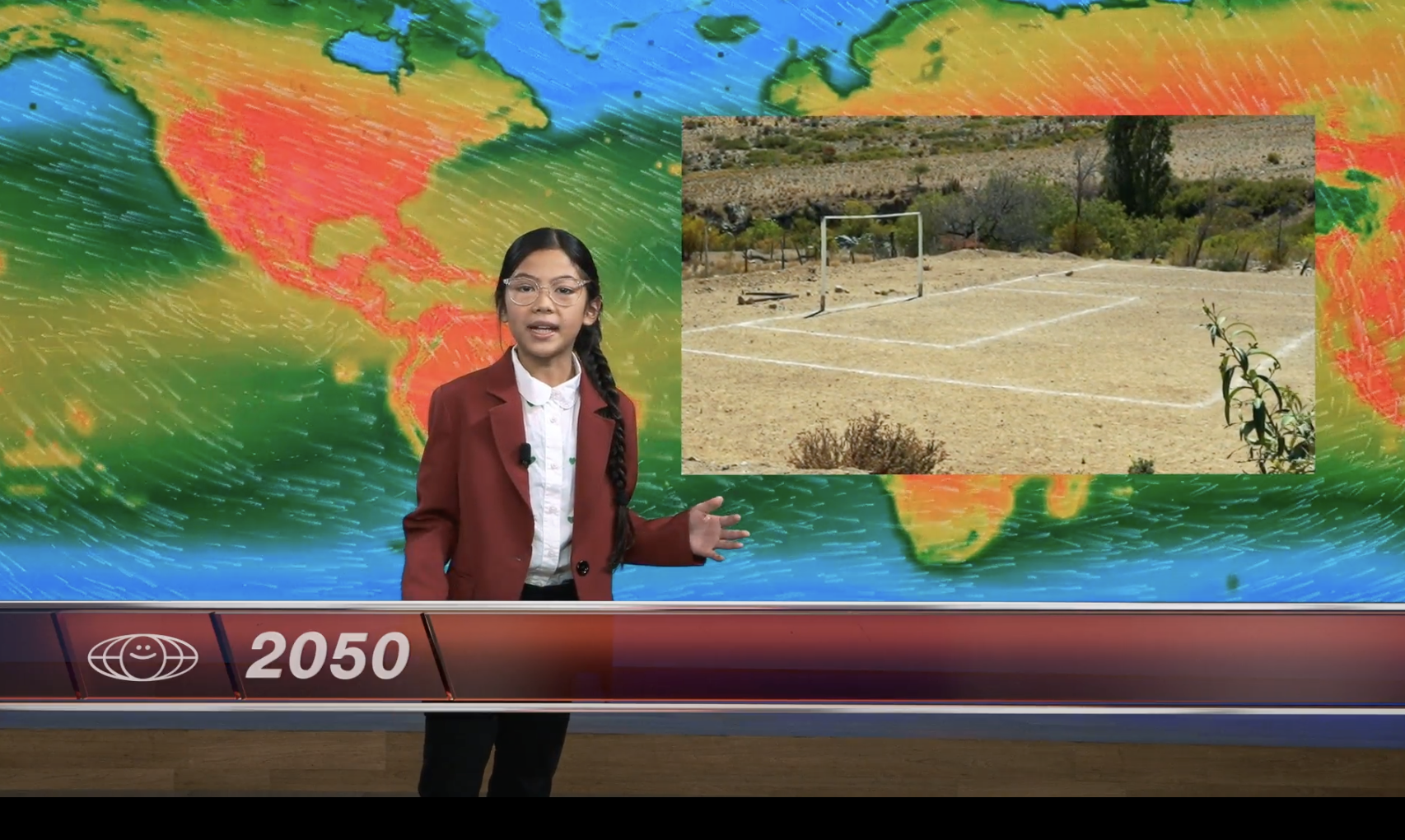

AI in weather forecasting, prediction and communication

Continue reading

Weather impacts everything, including you.

Enter

The Weather Company

meteorologists across the company drive confidence and innovation

And hold 185 patents that drive weather and societal progress

likely to have the most accurate forecast than any other provider1

Most Trusted Brand in the U.S2

The Weather Channel is the only tech or media brand to hold this distinction

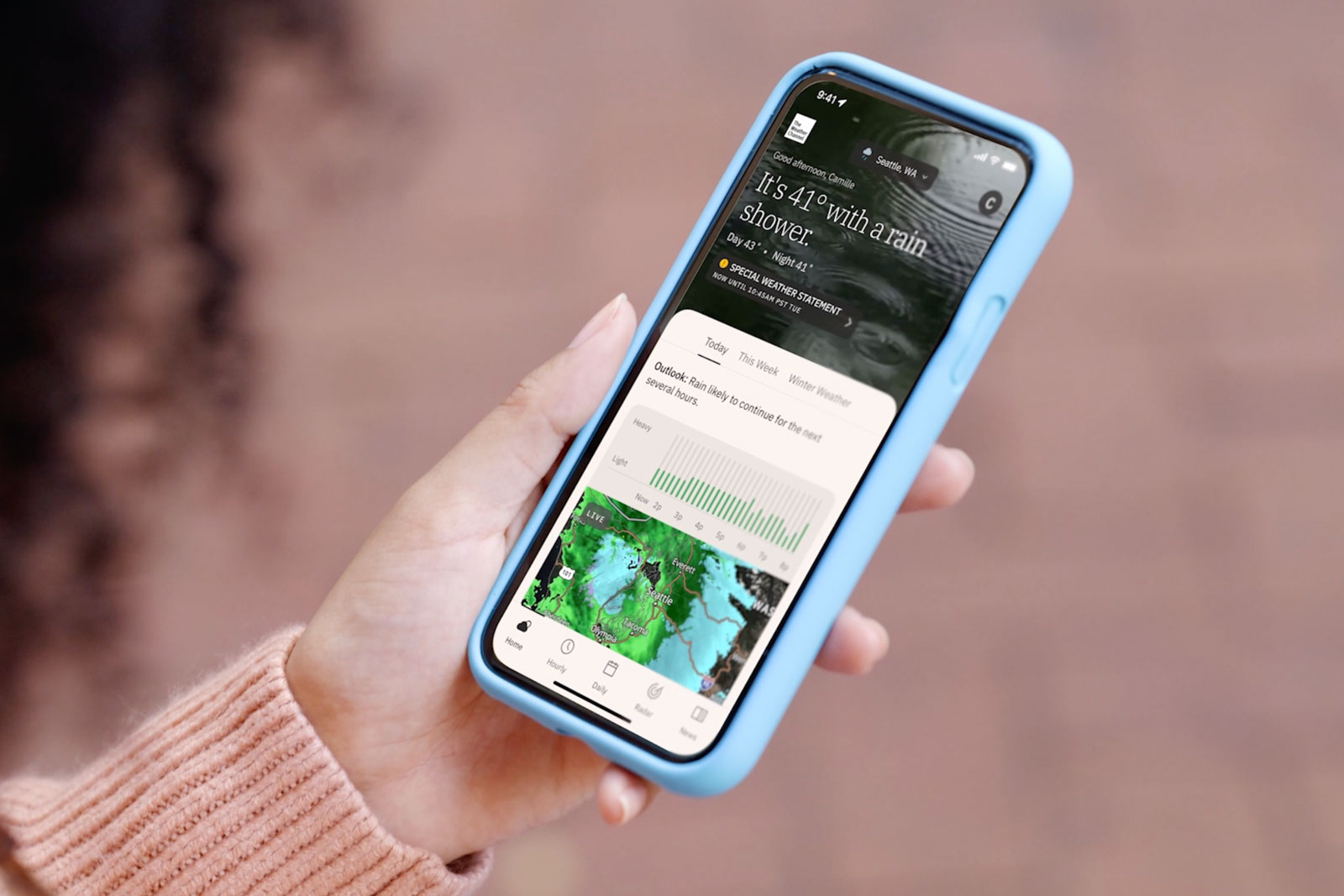

downloaded weather app

The Weather Channel app has 3x more cumulative downloads than the closest competitor3

weather forecasts produced each day for 2.2B locations

consumers visit one of our digital properties each month4

global broadcasters use our data and visualizations to engage their audiences5

enterprise customers leverage our weather insights to drive growth

flights per day rely on us for safe passage and timing efficiencies5

Who we serve

Success stories

Let’s talk

To learn more about harnessing the power of weather to make better, more informed decisions across industries, contact our experts today.

Contact us1 ForecastWatch, Global and Regional Weather Forecast Accuracy Overview, 2017-2022, commissioned The Weather Company

2 According to a Morning Consult May 2023 survey, The Weather Channel brand was the #9 most trusted brand in the US. The surveys were conducted from March 3, 2023 through April 3, 2023, among a nationally representative sample of 799 to 8,434 U.S. adults.

3 According to data.ai Intelligence, The Weather Channel has been the world’s most-downloaded weather app across Apple’s App Store and the Google Play store beginning on July 4, 2010 and into 2023

4 Based on the average of the total monthly (non-unique) users for Jan – June 2023 across The Weather Company digital properties and consumer products (weather.com, The Weather Channel app, Weather Underground app, wunderground.com, Storm iOS app, ) according to The Weather Company internal data

5 Based on The Weather Company internal client data